Leveraging land into an income-producing portfolio

FEATURE | Investing in specific land can be a great way of protecting oneself against inflation and

devaluing of cash

The umbrella of real estate investments shelters an array of options and decisions but, regardless of the property path chosen, all of it is anchored in the land.

A real estate portfolio is simply some combination of different real estate investments, aimed to fulfil a particular objective.

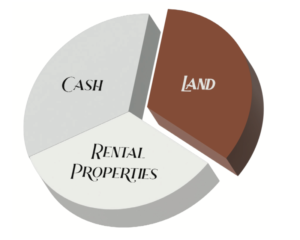

Different property types and markets will carry varying levels and types of risks. At a portfolio level, diversification considerations are vital for reducing risk and increasing expected returns. Including properties in different sectors can help reduce macroeconomic risks that one sector may face. Additionally, combining land into an income portfolio and vice versa can offer further diversification benefits.

As with most investments, returns come in two main forms: income returns and capital gains. Take a multi-family building, for example. The return generated today from that investment is the rent minus expenses and debt services. When you sell that asset 10 years down the road, the difference between the original purchase price and sale price minus debt servicing is your capital gains return. It is crucial to note that the two types of returns are treated differently for tax purposes.

With land, assuming it is just raw dirt and has no income cash flow, the return depends on capital gain once you decide to sell. While this may sound daunting, it may not necessarily make land any less favorable than income properties.

The real return of any investment is moderated by the rate of inflation, captured in the concept “time is money”. Simply put, you can buy more today with $100 than what in 10 years with that same $100.

However, real estate values, particularly land, tend to increase dramatically, especially in fast-growing markets like the Fraser Valley or Metro Vancouver.

Land as a hedge against inflation

It is the land, not the house on it, that is the reason that residential price appreciation has consistently outpaced the rate of inflation. In Metro Vancouver, for example, the appraised value of a 40-year-old non-improved house can be worth 100 per cent more today than 10 years ago simply because of the value of the land beneath it. If the land has the potential for higher-density development, the return can be even more spectacular.

Consider this real-life example, based on a 2021 appeal of a BC Assessment of a 3.7-acre property in Surrey with an existing single-family house. The land had been designated by the City of Surrey as a potential townhouse development site when it approved the Redwood Heights Community Plan in 2020.

BC Assessment therefore increased the assessed value from a year earlier by 55 per cent to $8.34 million. However, the aging two-storey house was valued at just $10,000, the same as it had been the year before and the year before that. The assessment was upheld in the appeal.

This clearly illustrates the attraction of investing in land due to the greater expected upside.

One possible strategy an investor may employ is to combine land and income in their portfolio is to acquire properties in different sectors that have positive cash flow. They then can reinvest a portion of that cash flow into raw or development land. This has the potential to increase both diversification benefits and the expected return.

Five big questions to ask when buying vacant land:

What is allowed to be built on it?

This will depend on the zoning and community plans. Check the official community plan and neighborhood community plans through city hall.

What can I build?

Just because something is allowed does not make it feasible. The area might have too many slopes or creeks, limiting the development potential, due to setbacks or access challenges.

Is there demand for what I could build?

Some property types are not ideal for certain communities. Looking at the overall community and tenant consideration can provide insight into this question.

How much will the debt payments cost?

Since there is likely no income, how do you plan on making the debt payments? Consider different scenarios because things don’t always go according to plan.

Why is the land vacant?

Maybe it is a great opportunity, or perhaps there are problems that may not be initially apparent, such as soil conditions or contamination.

– With thanks to Joe Varing, Varing Marketing Group, HomeLife Advantage Realty (Central Valley) Ltd.

View the original article here: Western Investor Feb 2022: Leveraging Land into an Income-producing portfolio

Interested in more updates like this?

Get news articles, advice, and market activity straight to your inbox.