Retail Spending Moderates as Historic Distribution Demand Relents Across Western Canada

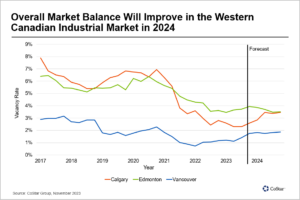

A More Balanced Industrial Market is Expected in 2024.

Overall, retail spending has now moderated in Alberta and British Columbia.

As the economy continues to cool and interest rate hikes hit an increasing number of homeowners, spending will likely suffer, and with it, the demand for industrial distribution space. The increased contribution from e-commerce sales won’t be enough to prop up overall demand, leading to further cooling in the once white-hot distribution markets of Western Canada.

Consumers appear to be settling into new shopping patterns, holding off on big in-store purchases while turning to online shopping in search of discounts.

Similarly, and for the most part, distribution tenants appear to have secured the spaces they need. Future demand is anticipated; however, the torrid pace of absorption over the past two years amounts to a demand correction, with future needs coming at a more moderate and less frantic tempo.

Total industrial space under construction across the three markets has been in decline and is now 15% lower than 2022 volumes while remaining nearly double 2020’s eight million square feet. In the Alberta markets -- where land can be secured as low as a tenth of Vancouver’s pricing -- buildings have been racing out of the ground on a speculative basis and have often been delivered to the market fully occupied.

However, of the 7.5 million industrial square feet delivered through 2023, 20% remains vacant. Calgary’s 5.3 million square feet of 2023 deliveries sits 10% vacant, while Edmonton’s 2.2 million square feet is 40% vacant.

The price of land and the favourable provincial and municipal tax environments create a more palatable carrying cost for these vacancies. Vancouver’s 4 million square feet delivered this year is 9% vacant. Only two buildings offer more than 50,000 square feet of contiguous space.

Due to its land constraints, Vancouver will continue to rely on pre-leasing arrangements before starting construction projects. In most distribution or logistics building cases, it is tenants looking for buildings, as opposed to buildings looking for tenants. Spec builds in the Vancouver market will continue to be a rarity, while Alberta markets will likely see fewer of these builds as the markets adjust.

All three markets reached their vacancy low points in 2022: Vancouver at 0.7%, Calgary at 2.4%, and Edmonton at 3.5%. Unwinding or plateauing of these vacancy rates will continue in 2024, with each achieving better balance than past years. Vancouver will approach 2% in the year ahead whileCalgary could unwind to 3.5%. Meanwhile, Edmonton is expected to maintain its current level of 3.5%, the result of a less feverish construction buildup over the past year.

The events of the past four years have resulted in a significant acceleration of change to consumer spending habits, construction and building innovation, and the more widely adopted notion of Western Canada as one market from a distribution perspective. As the economy continues to cool, it will provide the industrial markets with time to cool before moving forward in an even more disciplined manner as it deals with more predictable demand in an environment with better balance.

CREDITS:

Paul Richter | Dir. Market Analytics

He is the Director of Market Analytics at CoStar - the leading provider of commercial real estate information, analytics and online marketplaces. Paul has worked with teams of dedicated analysts, across the country, to help clients make more informed decisions related to their commercial real estate businesses.